World

The biggest producers of the world furniture market are China, USA and Germany. Due to its low labor cost, increased income and increasing domestic demand, China’s place is centered in furniture production and has more than 1/3 of the world production.

Germany and the USA have the leading position in raw material supply and the use of technology, and Italy has the leading role in design. According to the estimated data for 2018, 54% of the world's furniture production belongs to the Asia and Pacific Region. The EU, Norway, Switzerland and Iceland rank second with 24% share, and North America with 15% share.

The production in Russia and European countries outside the EU within which Turkey is also grouped, corresponds to 2% of total production.

According to the report published by the Center for Industrial Studies (CSIL) in 2019, worldwide furniture consumption was over $ 431 billion in 2017, and it is estimated that this figure would reach 458 billion dollars in 2018. The Asian market in particular has begun to play an increasingly important role alongside the large traditional markets. Per capita furniture expenditure is increasing especially in Asia Pacific and North America.

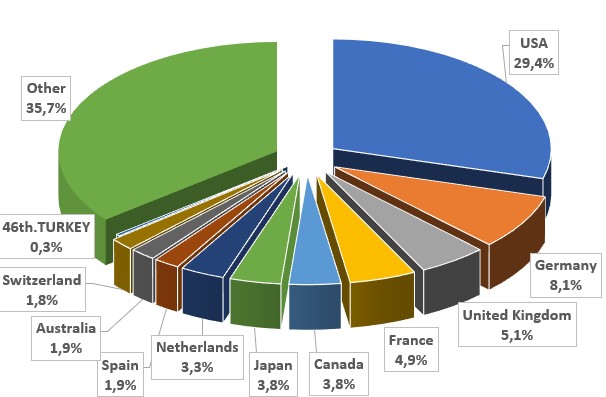

Chart 1– World Furniture Export

Source: Trademap

Chart 2- World Furniture Import

Source: Trademap

Turkey

Chart 3- Turkey’s Furniture Export

Source: The Turkish Statistical Institute (TÜİK)

All Companies